Many economists, analysts, financial advisors and consultancies are providing existing and new means to solve the US debt issue. One more left field approach is to target GDP. Undertaking this explicit way to raise inflation help raise nominal GDP to 4-5% from the paltry 1.0 at the second quarter of 2011. To do this the Federal Reserve would have to take Quantitative Easing to another new found level - that is, printing an abundance of more money. Recent posts on this site, believe QE3 would not work. That is, because consumers never saw much of the QE1 and QE2 attempts to kick-start demand and growth.

As it stands, the US nominal GDP is plateauing. If it falls, then the US have a big problem, and debt will cause far more grief. Whilst right now there is no major Fed movement to have such a mindset change to their policy. Ben Bernanke's recent speech indicated that there is many more places to move should things continue to burn out...quite possibly this new approach could be on the agenda in months to come. At the end of the day the US Fed needs to look at all avenues, but one thing is for certain - money needs to be channelled through to those that will do the spending.

Providing financial, economic and organisational thought-leadership on the world we live in

Sunday, August 28, 2011

Sunday, August 21, 2011

Western Europe - Tangibly Beautiful, Balance Sheet Unfathomable

The clamour for bailouts of various kinds grows ever louder around the world. Governments around the global are looking to bailout countries from their sovereign debt. Pleas are being shrieked to protect investors and creditors.

Unconditional bailouts as per 2008 are not the answer. Keynesian economics believes we should succumb to transparent losses, and develop new regulatory frameworks that prevent governments and businesses sinking so deep into debt-riddled quagmires. Regulations should restructure too-big-to-fail organisations into smaller organisations. Liquidation of firms should not be feared. These are big statements, ruthless ones, but ones where future leaders of governments and organisations should take heed of.

Europe is most definitely “on the brink” of a serious economic crisis that could involve widespread defaults or significant inflation or both. At the same time, Bank of America shares this week fell to their lowest in two years; with other large banks under pressure, there is a legitimate fear of rerunning the parts of the financial crisis of 2008-9.

For Europe, a beautiful region the envy of every other continent to travel and be submerged in esethicism, is confronted with deep crisis with potential cataclysmic effects. As recently as 2008/09, there were three kinds of government support available to the American and European economies when such systemic financial trouble hit. But all three traditional forms of bailout are now much harder to pull off.

1. First, over the last 30 years interest-rate cuts and other forms of expansionary monetary policy became standard practice in the face of potential financial market disruption. Therein lies a problem. The globes interest rates have been slashed since 2008 in most crises-laden parts of the globe. Despite the The European Central Bank (ECB.) has room to cut rates — but both the ECB and the Federal Reserve fear that inflation may soon return. If inflation returns due to prices soaring, yet people not spending, it falsifies the whole rationale of interest rate cuts.

2. Second, after the initial monetary policy response in 2008, it was fiscal policy that took the lead in preventing global economic free fall — with significant attempts to provide countercyclical stimulus in the United States, much of Western Europe, and China. Now the european zone faces a series of fiscal crises. Further stimulus is out of the question — the issue in Europe is who will do what kind of austerity and how fast.

Unconditional bailouts as per 2008 are not the answer. Keynesian economics believes we should succumb to transparent losses, and develop new regulatory frameworks that prevent governments and businesses sinking so deep into debt-riddled quagmires. Regulations should restructure too-big-to-fail organisations into smaller organisations. Liquidation of firms should not be feared. These are big statements, ruthless ones, but ones where future leaders of governments and organisations should take heed of.

Europe is most definitely “on the brink” of a serious economic crisis that could involve widespread defaults or significant inflation or both. At the same time, Bank of America shares this week fell to their lowest in two years; with other large banks under pressure, there is a legitimate fear of rerunning the parts of the financial crisis of 2008-9.

For Europe, a beautiful region the envy of every other continent to travel and be submerged in esethicism, is confronted with deep crisis with potential cataclysmic effects. As recently as 2008/09, there were three kinds of government support available to the American and European economies when such systemic financial trouble hit. But all three traditional forms of bailout are now much harder to pull off.

1. First, over the last 30 years interest-rate cuts and other forms of expansionary monetary policy became standard practice in the face of potential financial market disruption. Therein lies a problem. The globes interest rates have been slashed since 2008 in most crises-laden parts of the globe. Despite the The European Central Bank (ECB.) has room to cut rates — but both the ECB and the Federal Reserve fear that inflation may soon return. If inflation returns due to prices soaring, yet people not spending, it falsifies the whole rationale of interest rate cuts.

2. Second, after the initial monetary policy response in 2008, it was fiscal policy that took the lead in preventing global economic free fall — with significant attempts to provide countercyclical stimulus in the United States, much of Western Europe, and China. Now the european zone faces a series of fiscal crises. Further stimulus is out of the question — the issue in Europe is who will do what kind of austerity and how fast.

3. Third, in 2008/09, monetary and fiscal policies were complemented by government capital injections directly into United States and European banks. New legislation introduced has made this harder to achieve and with recent commitments by Congress to seize injections of cash without consequences.

Therefore the worst financial-sector problems are in Europe. Countries are stricken with immense debt that is not repayable without austerity from the entire European region. The problem with this region is they recently did not include default events in 2010 in their stress testing of financial health that now appear inevitable. Such mismanagement is no coherent financial sector policy within the euro zone.

What are the policy options now? The people in charge of European policy would clearly prefer to do nothing or postpone dealing with the underlying issues. This is a bad idea as it puts markets in charge — and these markets are panicked.

The Europeans have to decide, once and for all, which governments will restructure their debts and which will be protected — to an unlimited degree — by the European Central Bank. A full-scale bank recapitalisation program is required, along with management changes at almost all major European financial institutions.

If the Europeans fail to get a grip on their economic situation, the cataclysmic financial crisis might start impacting on the tangibly beautiful.

Saturday, August 20, 2011

The globe is screaming Bear Market - This is not just over-reacting markets

Media coverage is running rampant, markets are taking a hammering, yet recovering, sovereign debt is sky high, yet many Government's keep highlighting the markets are just over-reacting from scar tissue from 2008. However the globe is screaming bear market.

Now incredibly, nearly three years later and in spite of central banks and powerful governments taking unprecedented and historic measures to right the global economy, we find ourselves steadily drifting toward the white water of another financial waterfall.

1. Standard & Poor’s downgraded, rightly or wrongly, the U.S. credit rating with a negative outlook. Over the medium term, this can’t be good for equities markets or corporate profits as confidence has been damaged, interest rates will very likely rise, growth will probably slow and all of this could work together to easily tip an economy that grew at just 0.8% in the first quarter into a double-dip recession.

2. China pounced on the U.S. downgrade, but things aren't so rosy for the dragon either, as its economy slides into contraction, according to a recent purchasing-managers index from HBSC that came in at 49.3 for July — a level not seen since the end of the financial crisis in March 2009.

3. Italy and Spain continue their convulsions, so strong and persistent that an emergency weekend phone meeting was called among European leaders, a couple of whom had to interrupt their near-sacrosanct August vacations to attend. German investor sentiment and PMI are also in decline, and a slowing German economy can only add to the already dour outlook for the once-shining euro and the global economy.

4. Economic reports at home continue to be dismal and clearly indicate a slowing second quarter on top of a razor-thin, first-quarter growth rate that makes for a difficult math problem to come out with a positive bottom line for the second half of 2011.

Global Government's need to take action, rather than 'out-skirt' economic management and realise traditional principles of economic policy and management have failed miserably. Highlighting markets over-reacting is a cop-out and proper economic management is a MUST

Now incredibly, nearly three years later and in spite of central banks and powerful governments taking unprecedented and historic measures to right the global economy, we find ourselves steadily drifting toward the white water of another financial waterfall.

1. Standard & Poor’s downgraded, rightly or wrongly, the U.S. credit rating with a negative outlook. Over the medium term, this can’t be good for equities markets or corporate profits as confidence has been damaged, interest rates will very likely rise, growth will probably slow and all of this could work together to easily tip an economy that grew at just 0.8% in the first quarter into a double-dip recession.

2. China pounced on the U.S. downgrade, but things aren't so rosy for the dragon either, as its economy slides into contraction, according to a recent purchasing-managers index from HBSC that came in at 49.3 for July — a level not seen since the end of the financial crisis in March 2009.

3. Italy and Spain continue their convulsions, so strong and persistent that an emergency weekend phone meeting was called among European leaders, a couple of whom had to interrupt their near-sacrosanct August vacations to attend. German investor sentiment and PMI are also in decline, and a slowing German economy can only add to the already dour outlook for the once-shining euro and the global economy.

Global Government's need to take action, rather than 'out-skirt' economic management and realise traditional principles of economic policy and management have failed miserably. Highlighting markets over-reacting is a cop-out and proper economic management is a MUST

Regardless of the Organisation's design - speed and efficiency is paramount in lean times

Functional, Divisional, Matrix, Networked, Cluster, Process, Geographic, Customer-back, Life-Form structures all exist in some shape or form in many organisations. Many C-Level executives mandate consultants or HR divisions to develop a new structure. The problem is a new structure is just a new structure. The key for organisations is to come up with a new design that will achieve the following objectives:

- Is the organisation capturing the necessary sources of competitive advantage in each market it participates in?

- Is the corporate core helping the market-facing business units rather than impeding them achieve their objectives and important financial metrics?

- Does the organisation capture the strengths, motivations and weaknesses of its talent?

- Does it facilitate different cultures across different parts of the business i.e. regulated division vs. unregulated?

- Does the organisation provide coordination for unit-to-unit links that are likely to be problematic?

- Does the organisation enhance efficiency, effectiveness?

- Does the organisation equip the organisation to maximise revenue and profits, whilst containing cost bases?

- Does the design of the organisation drive effective governance and control systems?

- Is the organisation designed to adapt to rapid change requirements in strategies enforced by external markets?

- Does the organisation reflect the complexity of markets and industry relationships whilst being sufficiently straightforward for stakeholders to understand and optimal work with and co-exist?

Thursday, August 18, 2011

Re-cutting and restructuring budgets - Don't forget Social Media

Now is the time for learning professionals to embrace social media as an emerging and engaging way to enhance an organisation’s strategy. A confluence of issues, both mitigated and unmitigated, has arisen over the past several quarters. Budget cuts, staff reductions, travel embargos, and facility consolidation have left many chief learning officers, chief marketing officers, and chief operations officers clamouring for the emergency brake. Add to this the rising inferno of social media, informal learning, and anything to do with a 2.0 moniker—and a full-blown learning crisis is existing for improving learning for employees, marketing with intent for customers, and expending the right energy on retention and acquisition of customers whilst providing your core operation.

Given this pending calamity, it’s time for business leaders to rethink their strategy to make enterprise 2.0 an important piece of the corporate spectrum if you want to stay ahead of the game. Leaders should be embracing it, but it does require new approaches in leadership and budget planning to successfully execute, rather than simply tightening the purse strings on conventional marketing, learning, operations. This spend should be transitioned to enterprise 2.0 spend.

More with less

Despite recent and modest gains in the economy, the latest US credit downgrade, Europe sovereign debt crisis and general contraction globally, training budgets are going to plummet. It always does in firms when budgetary pressures rear their ugly head. During these times executives preach to senior managers and senior managers preach to middle managers to do “more with less” is. No matter the study, training, traditional marketing, service budgets have been and continue to reduce or run flat. Whilst social media marketing budgets might be increasing, organisations are showing a tendency to transition traditional forms of marketing professionals into this field. The problem with this is the professionals have distinctively different skill sets.

In a 2009 IDC report, training budgets decreased on average by 19.5 percent. ASTD research also suggests that corporate learning investment, as a percentage of company payroll, has decreased from 2.24 percent in 2008 to 1.96 percent in 2010. Clearly, a fiscal pattern is emerging and corporate learning budgets are running flat or, worse, dramatically shrinking.

Furthermore in the downturn from 2008 to 2010, service budgets have been slashed, with talent being let go, downsizing conducted with broad brushes. Refocusing service efforts into the social media channel would likely offset any need to downsize.

Enter Enterprise

Given the meteoric rise of social media in the consumer space, it was only a matter of time before various 2.0 technologies surfaced within the organisation. Not only is it crucial that organisations embrace social media to understand consumers, companies need to restructure for social media, particularly within marketing, customer analytics, and business intelligence groups. It is a whole of business paradigm shift, not just required to lazily go where the interest is. Furthermore it should not be viewed as a time wasting tool.

This is where the concept social learning comes into play. Social learning can be thought of as the use of Enterprise Enterprise

Social media and enterprise 2.0 within organisations is essential to capability building and transforming talent from point A to B, finding the next best product, building a consumer-fellowship, distributing product and services via new channels. Gartner predicts that by 2014, social learning-like services will actually replace email as the primary communications vehicle for at least 20 percent of the workforce. Clearly, change is upon us all. Therefore, if planned correctly, social media and appropriate mobilisation of capability can not only help with the points of practicality and engagement, it can also assist those aforementioned budget problems.

Restructure for Enterprise

Prior to solving the budget issue, organisations need to structure and build an organisation that can leverage social media for it’s multitude of purposes: learning, marketing, product development analytics, and customer understanding. Organisations need to develop an organisation within the organisation focused on enterprise 2.0. Regardless what industry the organisation plays within, social media implications exists. For fast-moving consumer goods companies – customers want the latest deal, and want to know where, via a social media means. Conversely, the company wants to know consumer preferences to develop new products and augment existing ones. What better way to understand this through the enterprise 2.0 social media ‘like’ functionality permeating the online world now. Share of wallet has never been so crucial for banks, and customer churn is the death spiral – financial services firms need to leverage social media to look at methods to cross-sell, bundle products, to the savvy social customer. Energy companies need to educate about environmental footprints, customer awareness on energy usage, help their communities with demand management – channelling this through to the mass market via social media is a must to have a hard-hitting impact.

Nevermore has the matrix structure been more pertinent in building a social media organisation within the construct of an existing organisation. Social media and enterprise 2.0 capabilities need to permeate almost every function of the organisation. Hence the social media operation needs to be virtual. A word that is synonymous with this capability. These professionals with dedicated functional expertise be it marketing, customer analytics, business intelligence, ICT, or sales and operations, need to work across the traditional forms of the organisation yet act as a remote community to bring the organisation on the Enterprise

Example Enterprise 2.0 Organisation Blueprint - Investment is required for all industries today

But where is the ROI?

There are plenty of individuals within the Enterprise

Did the sales team wait for an ROI calculation before trying to get a leg up on the competition by offering a differentiated product or service? No, it just made sense. Social media, in this case, is analogous to investing in something new and it must start strategically and organisationally. It’s time to evade those budget cuts and begin investing in an area that will only show growth for years to come.

Does Corporate Culture impact P+L performance?

Organisations are forever looking at corporate culture. Trying to improve it, before have a solid taxonomy or understanding about what it actually is. For organisations to capitalise on culture and translate it to organisational performance a direct link needs to be made about company culture and the impact it can have on long-term economic performance.

Strong cultures facilitate adaptation to economic change and turbulent environments. However can culture foster better or stronger financial results? Is there direct profit and loss impact achieved from a type of culture. For organisations that want their culture to positively and tangibly impact financial performance, the key is to embark on performance-enhancing culture change programs. Many mistakes organisations take is that they address the intangible, emotive language without having a direct correlation back to the hard tangible measures of a business in the form of performance KPIs, compensation systems. Executives asking their companies to change the intangibles because it’s the moral high-road will lead to failure and exhaustion of companies, divisions, functions, teams and employees. If culture is directly linked to the hard quantitative measures for companies, divisions, functions, teams and individuals then it becomes more real and the direct cause-and-effect on a balance sheet and profit and loss can be linked.

One standout Exhibit in that book highlights the difference in results over an eleven year period between twelve companies that did and twenty companies that did not have this sort of culture.

Average Increase for Twelve Firms with Performance-Enhancing Cultures | Average Increase for Twenty Firms without Performance-Enhancing Cultures | |

Revenue Growth | 682% | 166% |

Employment Growth | 282% | 36% |

Stock Price Growth | 901% | 74% |

Net Income Growth | 756% | 1% |

Table 1: How culture impacts financials -

The above table highlights that a performance enhancing culture drive equity value over 900%. Of course there are many other contributing factors that drive performance, but the difference between the four financial ratios in Table 1 are enough evidence, that organisations need to bring quantitative tangibility when driving culture. Executives and HR professionals need to roll up the sleeves and do some ‘heavy lifting’ in linking cultural performance directly to KPIs that track performance of employees, teams, divisions and codify these metrics with hardwires to financial performance. Otherwise employees will just continue to roll their eyes when an unrelated culture initiative is force-fed without any direct link to the very fabric of what the organisation stands for: its core operation and financial performance.

Wednesday, August 17, 2011

Designing your new organisation from scratch...Operating Model perspective

Organisations can’t succeed in business without an operating model that delivers value to customers at a reasonable price, with an underlying cost that allows you to make a profit. There are no “shortcuts” – for example, very few businesses thrive just because they offer the latest technology, or the new fad, except maybe Facebook etc.

This should seem logical for entrepreneurs, investors, venture capitalists, but what about organisations looking to reinvent themselves in tough times. Many investors have war stories about startup funding requests with major business model elements missing. This often leads to many common failures, as the solution is just looking to solve the problem, whilst giving away the product. This is why devising an business and operating model is so crucial.

Organisation's looking to reinvent need at least seven of the following ten principle elements to renew their organisation to capture new sources of value and revenue from customers. This is fundamental before an organisation embarks on a radical restructuring, talent renewal, performance overhaul without having the end-game designed and detailed. These elements are:

- Value proposition. What is the need you fill or problem you solve? The value proposition must clearly define the target customer, the customer’s problem and pain, your unique solution, and the net benefit of this solution from the customer's perspective.

- Target market. Who are you selling to? A target market is the group of customers that the startup plans to attract through marketing and sales their product or service. This segment should have specific demographics, and the means to buy your product.

- Sales/Marketing. How will you reach your customers? Word-of-mouth and viral marketing are popular terms these days, but are rarely adequate to initiate a new business. Be specific on sales channels and marketing initiatives.

- Production. How do you produce your product or service? Common choices include manufacturing in-house, outsourcing, off-the-shelf parts. The key issues here are time to market and cost.

- Distribution. How do you distribute your product or service? Some products and services can be sold and distributed online, others require multi-level distributors, partners, or value-added resellers. Decide whether the product is local or international.

- Revenue model. How do you make money? The key here is to explain to yourself and to investors how your pricing and revenue stream will cover all costs, including overhead and support, and still leave a good return.

- Cost structure. What are your costs? New entrepreneurs tend to focus only on product direct costs, and underestimate marketing and sales costs, overhead costs, and support costs. Test your projections against actual published reports from similar companies.

- Competition. How many competitors do you have? No competitors probably means there is no market. More than ten competitors indicates a saturated market. Think broadly here, like planes versus trains. Customers always have alternatives.

- Unique selling proposition. How will you differentiate your product or service? Investors look for a sustainable competitive advantage. Short-term discounts or promotions are not a unique selling proposition.

- Market size, growth, and share. How big is your market in dollars, is it growing or shrinking, and what percent can you capture? Venture capitalists look for a market with double-digit growth, greater than a billion dollars, and a double-digit penetration plan.

Investors, shareholders, employees and even customers, will want to understand the business and operating models of the organisation as it embarks on renewing itself. Admittedly they will want to understand from different vantage points, but nonetheless they all have the basic denominating question. Where is the value in it for me from my vantage point?

As organisations look to renew, stabilise, strengthen or just plain survive in this contracting economy, they must change their business and operating model, because knee-jerk changes like cutting off their face despite their nose. These principles just might help organisations with the how....

Recession Proof Business Models...

In this economy, organisations cannot always do what they have done. They need to adopt new business models that drive sales, whilst maintaining cost bases and whilst maintaining service levels to customers who care little for loyalty in tough times.

Organisations need to find new strategies in 2012 that protect their revenue pools and capitalise on their labour. These new business models then need to be brought to life through the organisation implementing a seamless, efficiency driven operating model. Organisations need to adapt new strategies to drive sales in 2012 and beyond! Imagine finding a BUSINESS MODEL that:

Organisations need to find new strategies in 2012 that protect their revenue pools and capitalise on their labour. These new business models then need to be brought to life through the organisation implementing a seamless, efficiency driven operating model. Organisations need to adapt new strategies to drive sales in 2012 and beyond! Imagine finding a BUSINESS MODEL that:

- Is recession proof – even a bad economy won’t affect this negatively

- Is proactive, not reactive – you don’t rely on consumers to respond you your expensive advertising to get a job

- Provides ongoing cash flow – generating work orders even in a down economy

- Enables you to build life-long relationships with customers enabling you to become their “contractor for life”

- Builds long-term company equity increasing the value and saleability of your business

In order to deliver this organisations need to first look at the value propositions the core competencies of the business can deliver and what target segments. Once these tested value propositions have financial merit and sustainability with target customers, organisations need to allocate appropriate resources, people, processes, technologies, data capabilities, to channels that can distribute these value propositions and differentiated sources of value to customers.

Once the channels have been established through the allocation of resources, organisations need to determine the type of relationships they business wants to provide to their customers. In lean times often value propositions need to be service based, with no frills. Determining the type of relationship an organisation wants to have with their customers, determines how the firm must organise its people, decision rights, motivators and KPIs and formal lines and boxes. The types of customer relationships that an organisation's business model could deliver are:

1. Personal Assistance: This is based on human interaction where the customer can communicate with a real customer representative to get help during the sales or post purchase process

2. Dedicated personal assistance: Involves dedicating a customer representative specifically to an individual client. It represents the deepest and most intimate type of relationships and develops over a long period of time.

3. Self-service: Where a company maintains no direct relationship post a sale

3. Self-service: Where a company maintains no direct relationship post a sale

4. Automated services: Mixes a more sophisticated form of customer self-service with automated processes.

5. Communities: Companies utilise user communities to become more involved with customers/prospects and to facilitate connections between community members.

6. Co-creation: More companies are going beyond the traditional customer-vendor relationship to co-create value with customers. For example Amazon.com ask customers to write reviews to assist with the design of new and innovative products.

During lean times, when developing a business model, the organisation needs to determine the revenue streams the business requires to keep cashflows generating through the business. As cash is king in a contracting economy. The business model the organisation should structure for is a recurring revenue stream as a risk mitigation. This results in customers having on going payments for the ongoing value proposition.

One of the most important requirements of making a new business model recession proof is to maximise the key resources such as physical assets, intellectual capability, human capital and financial resources. Without careful allocation, organisation and structuring, a business model is doomed to fail in lean times.

In any new business model, it is critical to develop key activities. In lean times globally, it is crucial that new business models only focus on core that is central to driving the value proposition. Any peripheral activities will likely impede the speed and effectiveness of a new go to market business model.

When organisations are looking at new business models to succeed in the current economic climate, a hedge-risk strategy is to force alliances, strategic partnerships and joint ventures to share cost, effort, time, and resources. With effective quality measurement indicators, this can be an effective business model variable that can derive much success. For example look at the Sony-Ericsson partnership and it's success or Delta and Air France to reduce costs and route management in different geographic regions.

The final part of crystallising a recession-proof business model is arguably one of the most important - the cost structure. This needs to describe, monitor and most importantly contain all costs whilst operating the new business model. In a contracting economy the organisation needs to ensure costs do not blowout. So called 'no-frills' for instance have built business models entirely around a low cost structure - like SouthWest Airlines. In lean times business models need to find a the right blend of a low cost vs. value driven cost structure. Low cost to ensure cash is prevalent within the firm but not at the cost of losing value to customers whose brand loyalty flies out the window in tough times.

When developing a business model there is no right or wrong answer, but when an organisation is looking to unlock value, having total regard for the entire system using a systems view and cause and effect logic for all the business model variables is crucial before organisations attempt to organise their business in lean times.

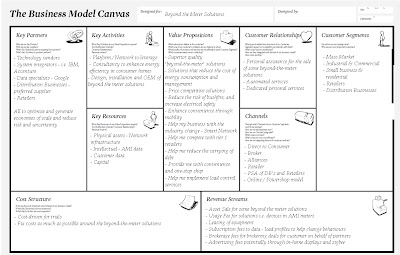

Example business model to pursue beyond-the-meter revenue for a Utility

Monday, August 15, 2011

Why Service in a Downturn is important?

During a downturn or a looming double dip recession, service operations have never been so important. The primary rationale for this is that during a downturn, cost management has never been so crucial, and a healthy balance sheet insulates big firms. So what does service have to do with this?

Do you have any idea the cost difference between getting a new customer compared to retaining a current customer? It costs 5 times as much to bring in a new customer, than to keep an existing one, as we all know. Now is time to ensure loyalty with your customers through utilizing the “back to basics” of customer service. It is a big chore for consumers to have to find another company to meet the needs that presently you fulfill. Customers want to be loyal. So, why do they leave? They leave because of a lack of attention to plain-old customer service. What's even more paramount, is that in lean times, customer loyalty falls by the waist-side. When lean times are forecast during the annual budget process, many training and development budgets are slashed and peripheral development programs are halted. This often results in no natural progression for service operations development within the firm. As a result service levels start to deteriorate or plateau, which ultimately impacts the customer experience in dealing with the organisation, prompting the consumer to think about trying other alternatives, seeking new products, or even new service experiences.

They key for organisations confronted with lean times, is to invest in the core. Invest in the very reasons why a consumer uses their service in the first place. When customers contact a company, customer service has an opportunity to improve or worsen the relationship with the customers. Hopefully service improves the relationship with customers. So, it would make good sense to make these contacts as meaningful and helpful to the customers as possible. Some key tips at driving high service levels during a slow economy are as follows:

Do you have any idea the cost difference between getting a new customer compared to retaining a current customer? It costs 5 times as much to bring in a new customer, than to keep an existing one, as we all know. Now is time to ensure loyalty with your customers through utilizing the “back to basics” of customer service. It is a big chore for consumers to have to find another company to meet the needs that presently you fulfill. Customers want to be loyal. So, why do they leave? They leave because of a lack of attention to plain-old customer service. What's even more paramount, is that in lean times, customer loyalty falls by the waist-side. When lean times are forecast during the annual budget process, many training and development budgets are slashed and peripheral development programs are halted. This often results in no natural progression for service operations development within the firm. As a result service levels start to deteriorate or plateau, which ultimately impacts the customer experience in dealing with the organisation, prompting the consumer to think about trying other alternatives, seeking new products, or even new service experiences.

They key for organisations confronted with lean times, is to invest in the core. Invest in the very reasons why a consumer uses their service in the first place. When customers contact a company, customer service has an opportunity to improve or worsen the relationship with the customers. Hopefully service improves the relationship with customers. So, it would make good sense to make these contacts as meaningful and helpful to the customers as possible. Some key tips at driving high service levels during a slow economy are as follows:

1. Do not slash the service training and development budget. Invest in the frontline, and improve service levels.

2. Make the consumer feel like they are all that matters

3. Re-organise the mindset of the organisation - ensure all overheads are working towards the quality service experience

4. Ensure the consumer's problem is solved and satisfaction levels are met

5. Ensure the organisation is explicit in defining its service experience. Managing consumer expectations often delivers a positive consumer service experience.

In lean times, service levels maintain consumer loyalty which has a direct flow-through correlation to an organisation's profit and loss. Whilst many argue the service experience is not the sexy part of a business model, it is often the interface to the transaction which is the bloodlines of an organisation's financial health, so getting it right is fundamental to surviving during a contracting economy. Thursday, August 11, 2011

In recessionary times, key actions for organisations

Whether or not organisations think the US or Europe are in a recession, just headed towards one, or that the economies never left the recession just shallowly recovered, there's no getting around the fact that the global is experiencing an economic downturn.

Declines in consumer confidence and decreased sales threaten all businesses, but small businesses are particularly vulnerable as they often don't have the reserves to help them weather difficult times.

In times of global downturns, organisations need to batten down the hatches and focus on the simplistic principles of good operations and do this exceptionally well.

1. Protect your cash flow.

Cash flow is the bloodlines and arteries of a business; to keep maintain organisational health, cash is king and needs to be flowing. As long as the organisation operates, expenses exist. But the harder times get, the harder it can be to keep the cash flowing in. Recession-proof strategies are required to maintain cash flow moving is essential. Rapidly secure funding to maintain liquidity is an absolute must. Cash might look a poor investment with low interest rates, dollar devaluation and rising consumer price inflation. But in a world characterised by asset price deflation then cash is still rising in value relative to everything else, except perhaps food and energy. Another way to look at this is to say: now that prices of houses or shares have fallen my cash will buy more of them. But it is hardly any wonder that even professional investors are confused about which way to jump at the moment.

2. Review your inventory management practices.

Reducing inventory costs without sacrificing the quality of goods or inconveniencing customers must be adopted. Often organisations in good times order too much of too many and this flows through to when times become tough. Organisations need to transform supply-side relationship and procure goods more creatively and only just what is needed. Just because you've always ordered something from a particular supplier or done things in a particular way doesn't mean you have to keep doing them that way - especially when those other ways may save you money.

3. Focus on your core competencies.

In times of a downturn, the diversification strategy sends dangerous alarm bells. Many articles on diversification as a strategy for organisational success in recessionary times are far and few between. Of course, innovation can flourish, even in the toughest economic, financial and regulatory climates. It is during tough economic climates, like recessions, depressions, regulatory constraints, and political/environmental instability where new companies or innovations by existing companies launched during these times transform current markets or create new ones.

For example, 25 of the companies that made up the Dow Jones Industrial Average in December 2008 were formed since the National Bureau of Economic Research (NBER) started tracking economic cycles in the US. 13 of those 25 including 3M, General Electric, Microsoft and Walt Disney were formed during a featured economic downturn or industry tipping point for transformation.

Many other notable companies came into their being in economically or regulatory difficult periods. A partial list of companies formed in the US in a year featuring a recession include:

Organisations | |||

Ann Taylor | Digital Equipment Corporation | Marvel Entertainment | Starwood Hotels & Resorts Worldwide |

Bain & Company | Dow Chemical | Mattel | |

Black and Decker | Dow Jones | McKinsey & Co | The Hershey Company |

Bridgestone | Electronic Arts | Merrill Lynch | Toys ‘R’ Us |

Church & Dwight | Eli Lilly | Newell Rubbermaid | Whole Foods Market |

Colgate Palmolive | Post Cereals | Scott Paper | |

Compaq | Harley Davidson | Progressive | Johnson Controls |

ConAgra Foods | iRobot | RCA | Cummins |

However, these companies are the exception to the law. Just adding other products or services to your offerings is not diversification and is a gamble. Chances are if an organisation is not delivering strong results in its core during a tough time, then branching out and focusing on something peripheral is even a bigger risk. At best, it's a waste of time and money. Worse, it can damage the core business by taking the focus, time and money away from what the organisation does best and/or damaging brand and reputation. Drop the extras and focus on what the organisation does best can be the most recession-proof modus operandi.

4. Develop and implement strategies to competition's customers.

If organisations are going to prosper in tough times, expansion of the customer/client base is crucial for success - and that means drawing in customers from the competition. How can this be done? Whilst diversification is not an option, differentiation from competitor is a solid avenue to capturing market share. Organisation’s need to make the intangible tangible to customers, and providing something unique either a new service, product augmentation or add-on feature. By offering something more or something different than the competition does. Researching the competition and determining what can be offered to entice the competitor’s customers jumping ship is a must.

5. Make the most of the customers/clients you have.

The old adage that a bird in the hand is worth two in the bush is paramount here. The bird in the hand is the existing customer or client and he or she is an opportunity to make more sales without incurring the costs of finding a new customer. Customer retention is far more profitable than customer acquisition and in lean times, a customer is always more inclined to jump ship to satisfy their needs faster, cheaper and more effectively. Loyalty often falls by the waistline during tight, tougher times. Hence organisations need to ensure the customer they have today, will remain their customer tomorrow.

Even better, he or she might be a loyal customer, attracting more sales opportunities through a share of wallet type arrangement where many varied products and services are accumulated by the existing customer. If organisations want to proof themselves for recession, they can ill-afford to ignore the potential profits of shifting their sales focus to include established customers.

6. Continue to market the organisation

In lean times, many organisations make the mistake of cutting marketing budgets to the bone or even eliminating it entirely. But lean times are exactly the times organisations need to enhance marketing. Consumers are restless and looking to make changes in their buying decisions. Organisations need to help them find their products and services and choose them rather than others. Quitting marketing is not an option. In fact, if possible, reinvesting more heavily in marketing efforts is the way forward.

7. Keep credit in good shape.

Hard times make it harder to borrow and with the recent US credit rating downgrade and uncertainty around European downgrades moving forward, loans are often among the first to disappear. This is particularly more important given major lending facilities are hoarding cash and only investing in lower-yield, lower-risk, longer-term opportunities. With good personal credit, organisations stand a much better chance of being able to borrow the money needed to keep their business afloat.

[1] Dow Jones analysis, 2010

Subscribe to:

Comments (Atom)